Bitcoin Mining Centralization in 2025

Tuesday, April 15, 2025This post explores Bitcoin Mining Centralization in 2025 by looking at the hashrate share of the current five biggest mining pools. It presents a Mining Centralization Index and updates it with the assumed proxy pooling by AntPool & friends. It shows that Bitcoin mining is highly centralized today, with only six pools mining more than 95% of the blocks.

In the current Bitcoin mining landscape, nearly the complete mining hashrate is controlled by a few large mining pools, which produce the templates for the blocks. These pools control which transactions they include in or exclude from their blocks. This doesn’t hurt Bitcoin’s censorship resistance as long as these mining pools don’t collude and decide to censor transactions. However, it raises the question of how many distinct block template producers exist. The 51%-attack, where a single miner or pool controls more than half the hashrate and can out-compete all other miners by building on its own chain, is well known. However, even with only 40% of the hashrate a pool has a ~50% chance of out-competing all other pools for six blocks 1. Are there pools with 40% of the hashrate today? And in general, how centralized is Bitcoin mining today? Especially with the assumed proxy pooling where smaller pools proxy the mining jobs of larger pools while putting their own name into the coinbase transaction.

This post explores Bitcoin mining centralization in two parts. The first part looks at the mining pool information included in the coinbase transaction. The second part takes the assumed proxy pooling into account. Both parts show the current biggest mining pools and a mining centralization index.

Measuring Centralization by counting Coinbase tags

Mining pools usually leave an ASCII tag in their coinbase transactions. For

example, the mining pool F2Pool includes the tag /F2Pool/. Additionally, mining

pools frequently reuse their coinbase output addresses. A dataset of these

identifiers can be used to find out which pool mined a block. For this

blog post, I’ve used the bitcoin-data/mining-pools dataset. To measure

the network share, I’ve looked at the blocks per day per mining pool

divided by the total number of blocks per day.

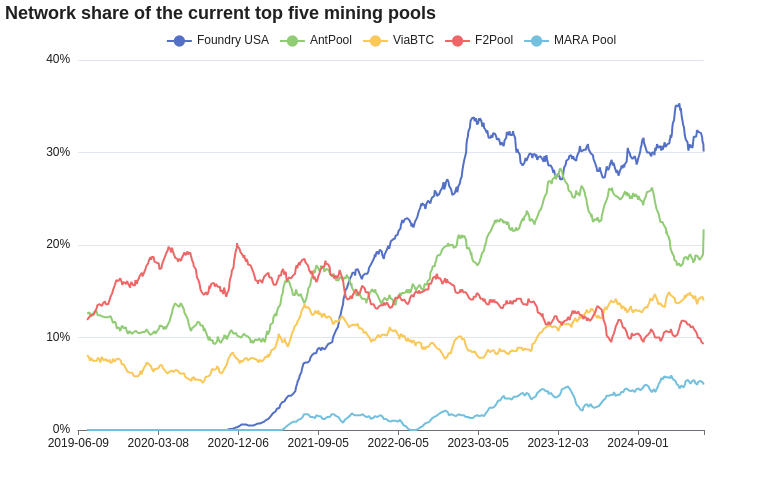

The data shown is averaged with a 31-day moving average.

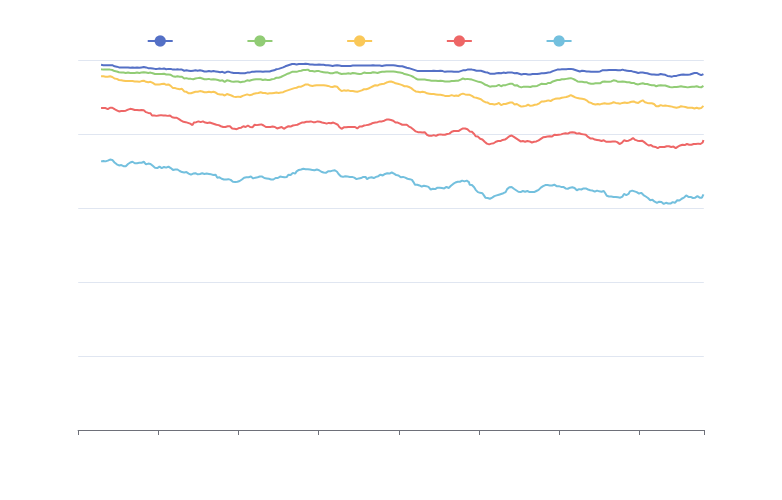

Currently, the five largest mining pools are Foundry (30%), AntPool (19%), ViaBTC (14.5%), F2Pool (10%), and MARA Pool (5%). Out of these, MARA Pool is the youngest pool, having started only in May 2021. Additionally, they are the only private pool in the top five. At the end of 2020, Foundry started mining its first blocks. After one year of operation, Foundry surpassed the other mining pools and became the largest pool with about 17% of the network hashrate. A bit more than another year later, in January 2023, Foundry reached 30% of the hashrate and has remained at this level since. AntPool, the mining pool owned by the ASIC manufacturer Bitmain, increased its hashrate from about 10% in 2020 to more than 25% in 2024 before dropping below 20% again at the end of 2024. Last year, ViaBTC overtook F2Pool in the race for the third place.

With the largest two pools currently having over 50% of the hashrate, followed by places three and four having another 25% together, 75% of the hashrate is controlled by just four pools. To put this into perspective, the following Mining Centralization Index can help.

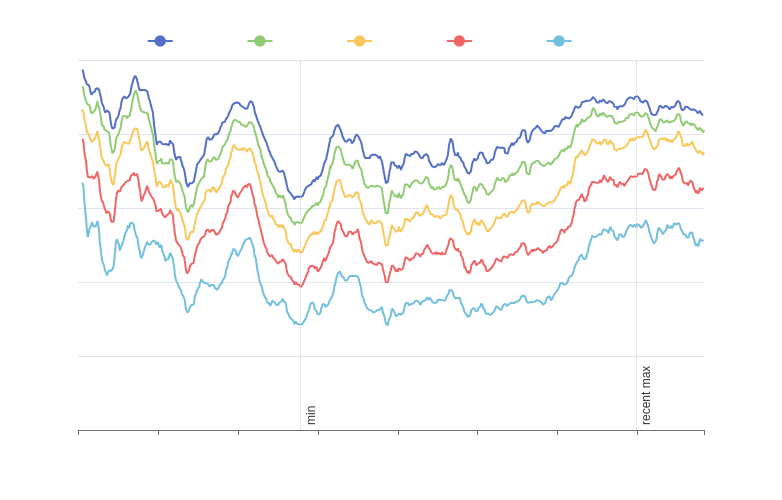

To measure the Bitcoin mining centralization over time, the Mining Centralization Index shows the hashrate sum of the largest 2, 3, 4, 5, and 6 pools at each point in time. Higher values mean more centralization.

For example, in May 2017, the top 2 pools together had a hashrate of less than 30% and the top 6 pools had less than 65% together. Then, Bitcoin mining was the most decentralized it has ever been in its pooled mining history. December 2023 is a strong contrast to this when more than 55% of the hashrate was controlled by the top 2 pools and 90% was controlled by the top 6 pools. Compared to the period between 2019 to 2022, where the top 2 pools had around 35% of the network hashrate and the top 6 pools had about 75%, Bitcoin mining is currently a lot more centralized.

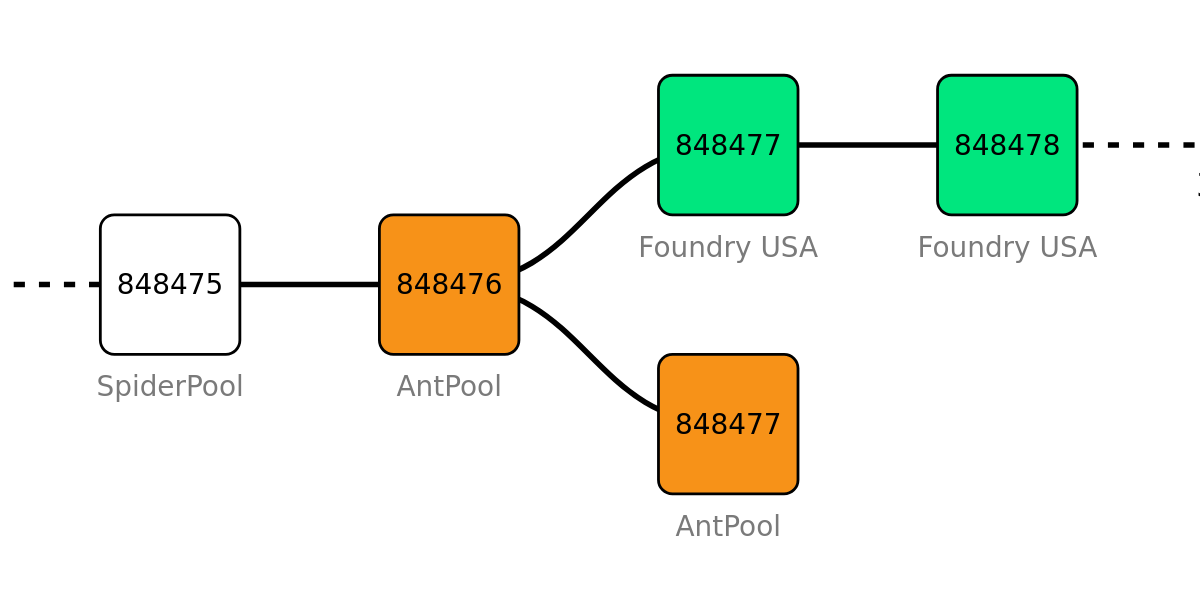

Measuring Centralization in times of Proxy Pools

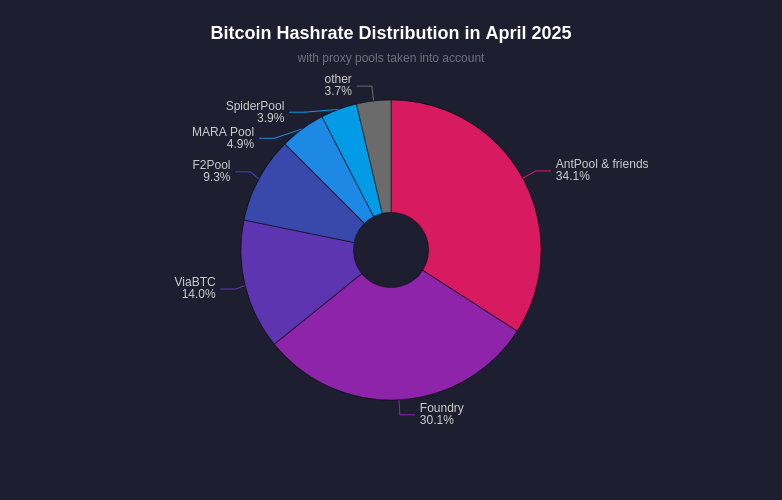

It has been observed that AntPool and multiple smaller mining pools send out very similar block templates. It’s assumed that these smaller pools are proxy pools for AntPool meaning they relay AntPools mining jobs but change the coinbase tags and addresses to their own. This causes hashrate estimates based on coinbase tags and addresses to become inaccurate. AntPool’s hashrate share is underreported as the blocks are attributed to the smaller miners. However, AntPool and these smaller miners, collectively referred to as “AntPool & friends” can be counted together as one big pool consisting of multiple pools. It can only be assumed which pools belong to the “AntPool & friends” group2, and it’s not clear when they joined that group.

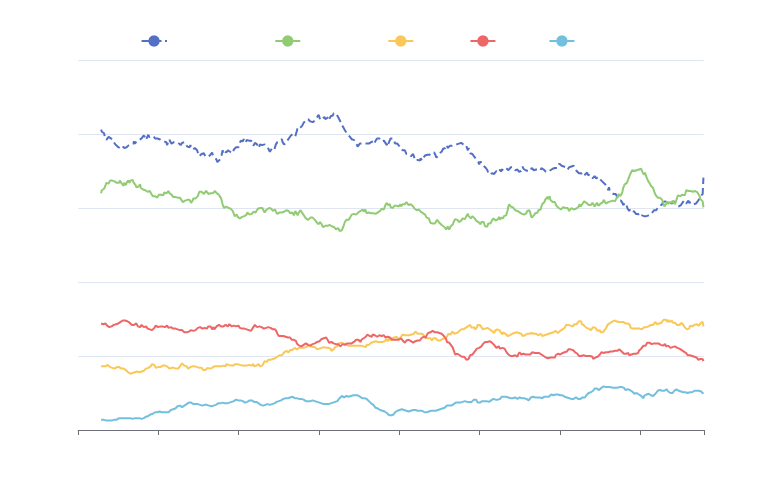

This chart assumes all pools considered a part of “AntPool & friends” were a part of it starting in 2023. Since this is not proven to be the case, assume a slight over-reporting of the hashrate share throughout 2023. However, the data should be more accurate for 2024, where “AntPool & friends” made up about 40% of the network hashrate. While AntPool & friends had a higher hashrate share than Foundry for the last two years, Foundry seems to have gained 5% while AntPool & friends lost the same share during early 2025. This trend seems to be reversing with AntPool & friends growing again.

Given that AntPool & friends have had a 10% to 15% higher hashrate share than assumed in the previous Mining Centralization Index chart, revisiting the index is worthwhile.

The Mining Centralization Index including AntPool & friends shows that over the last two years, AntPool & friends and Foundry together controlled 60% to 70% of the hashrate. However, even worse, 96% to 99% of the blocks were mined by only six mining pools. These numbers indicate that Bitcoin mining is heavily centralized around a few template-producing pools.

Bitcoin needs smaller pools like MARA Pool with 5% hashrate. Some large US mining companies could probably leave Foundry and start solo mining given their hashrate. Additionally, shifting hashrate to pools like Ocean (<1%) or DEMAND (0%), where miners build their own template, helps make Bitcoin mining more decentralized. More individuals home-mining with small miners help too, however, the home-mining hashrate is currently still negligible compared to the industrial hashrate.

To answer the questions from the introduction:

How many distinct block template producers exist?

We can’t know, but we know that six block template producers mine more than 95% of the blocks.

Are there pools with 40% of the hashrate today?

No, but it’s assumed that AntPool & friends controlled about 40% of the network hashrate in 2023 and throughout the first half of 2024. Foundry had about 35% in early 2025. Currently, AntPool & Foundry each have more than 30% of the hashrate.

How centralized is Bitcoin mining today?

According to the Mining Centralization Index, Bitcoin mining was most decentralized for a short period in May 2017. 2019 to 2022 was also a good period. Starting in 2023, Bitcoin mining has become more and more centralized, especially with large pools like Foundry and proxy pooling a la AntPool & friends.

As of writing, the following pools are assumed to be part of the AntPool & friends group: AntPool, Poolin (template similarities, invalid jobs, invalid jobs 2), CloverPool (formerly BTC.com, template similarities, invalid jobs 2), Braiins (template similarities, invalid jobs), Ultimus Pool (template similarities, invalid jobs, invalid jobs 2), Binance Pool (template similarities, invalid jobs), SecPool (template similarities), SigmaPool (template similarities), Rawpool (invalid jobs 2), Luxor (template similarities), Mining Squared (mining-squared). SpiderPool is currently not considered an AntPool proxy due to not having enough evidence for it yet. ↩︎

My open-source work is currently funded by an OpenSats LTS grant. You can learn more about my funding and how to support my work on my funding page.

Text and images on this page are licensed under the Creative Commons Attribution-ShareAlike 4.0 International License

Text and images on this page are licensed under the Creative Commons Attribution-ShareAlike 4.0 International License