The stair-pattern in time-locked Bitcoin transactions

The off-by-one-error that covered another off-by-one-error up

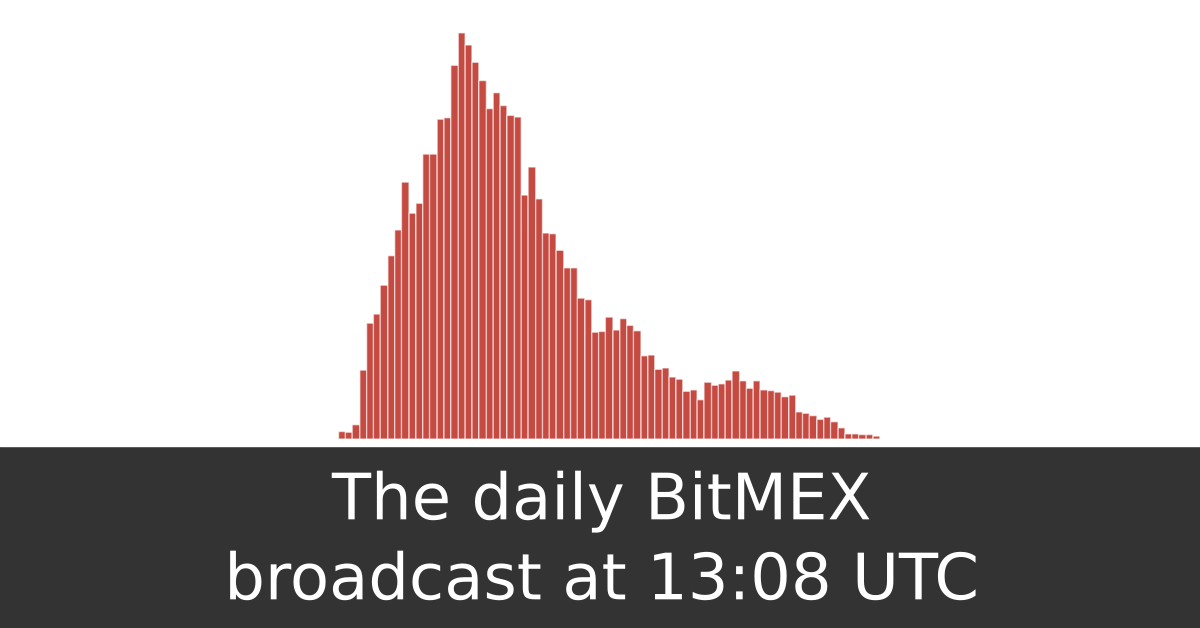

Monday, April 27, 2020Some of the regularly used Bitcoin wallets, for example, the Bitcoin Core wallet and the Electrum Bitcoin Wallet, set the locktime of newly constructed transactions to the current block height. This is as an anti-fee-sniping measure and visible as a stair-like pattern when plotting time-locked transactions by their mempool arrival time and locktime. The plot, however, reveals transactions time-locked to a future block height. These should, usually, not be relayed through the Bitcoin network.

Bitcoin transactions can contain so-called time locks as a time-based validity

condition. Different types of time locks are used in Bitcoin. The focus here

lies on transactions time-locked with a lock-by-block-height to an absolute

block height by utilizing the nLocktime field. This field holds a 32-bit

unsigned integer and is present in every Bitcoin transaction. A nLocktime

value between 0 and 500000000 specifies a lock-by-block-height. The Bitcoin

consensus rules define that a transaction with a lock-by-block-height of n can

only be included in a block with a height of n + 1 or higher. Likewise, a

block with the height n can only include transactions with a locktime of

n - 1 or less. At least one input of the transaction must have a

nSequence below 0xFFFFFFFF for the time lock to be enforced. Otherwise, the

lock is ignored. The Bitcoin Core software does not relay transactions with an

enforced locktime higher than the current block height.

Some Bitcoin wallets specify a lock-by-block-height with the current height when creating a new transaction. This makes a potentially disruptive mining strategy, called fee-sniping, less profitable. Fee-sniping is currently not used by miners but could cause chain reorgs in the future. Since the block subsidy declines to zero over time, transaction fees will become the main monetary incentive for miners. If a recent block contains a transaction paying a relatively high fee, then it could be profitable for a larger miner to attempt to reorg this block. By mining a replacement block, the sniping miner can pay out the transaction fees to himself, as long as his block ends up in the strong-chain. The fee-sniping miner is not limited to pick the same transactions as the miner he is trying to snipe. He would want to maximize his profitability by picking the highest feerate transactions from both the to-be-replaced-block and the recently broadcast transactions currently residing in the mempool. The more hashrate a fee-sniping miner controls, the higher is the probability that he will win the block-race. Miners have the risk of losing such a block-race, leaving them without reward.

A constant backlog of transactions paying a similar or even the same feerate would be needed to incentivize miners to move the chain forward. When mining a next block yields roughly the same revenue as sniping the previous, then a rational miner would not start a block-race. However, setting the current block height as a lock-by-block-height forbids a fee-sniping miner to use transactions from the mempool his replacement block. It creates an incentive to move the chain forward to be able to include the next batch of time-locked transactions in a block. While this does not fully mitigate fee-sniping, it reduces profitability. The more transactions enforce a time lock to the current block height, the less profitable fee-sniping is.

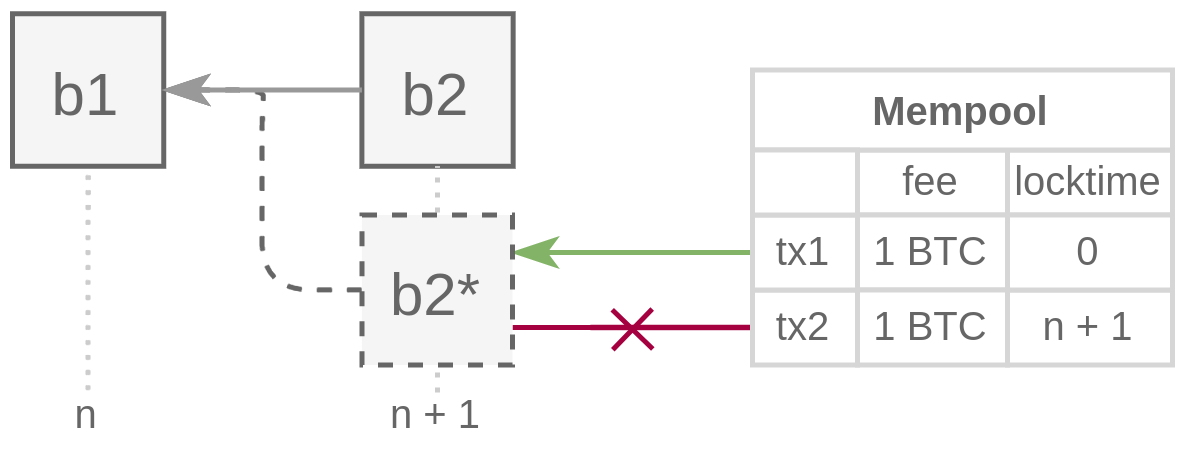

b2, with a height of n + 1, pays its

miner a high fee. Another miner, Eve, attempts to snipe block b2 with block

b2*. The mempool includes two transactions paying a relatively high fee of one

bitcoin each. However, Eve can only include transaction tx1 in block b2*.

Transaction tx2 can not be included in b2* as it is only valid in a block

with a hight of n + 2 or more.When the block height increases, the locktime newly constructed transactions should increase as well. Transactions with the locktime set to the current block height should appear as a stair-pattern when plotted by mempool arrival time and locktime.

Observation

Transactions observed by the Bitcoin Transaction Monitor project on December 17, 2019 are plotted. A stair-pattern of transactions with a lock-by-block-height is visible.

Some transactions are locked to a height below the current block height. These are likely not broadcast immediately after their creation. This happens, for example, with high-latency mixers and some CoinJoin implementations. Additionally, the Bitcoin Core wallet randomly chooses a locktime up to 100 blocks below the current height for 10% of the signed transactions to increase the privacy of the not immediately broadcast transactions.

The plot, however, does show transactions with two different locktimes arriving at the same time. Transactions time-locked to the current block height and transactions time-locked to the next block height. Between block 608511 and block 608512, for example, transactions with a locktime of 608511, the current height, and 608512, the next block height, arrived. These should, normally, not be relayed trough the network.

Interpretation

The transactions time-locked to the next block height have inputs with a

nSequence number of 0xFFFFFFFF. The lock-by-block-height is thus not

enforced. All of these transactions have common properties and share a somewhat

unique fingerprint. All are spending P2SH, nested P2WSH, or P2WSH inputs and are

BIP-69 compliant (inputs and outputs ordered lexicographically). Most of

them pay a feerate of 12.3 sat/vbyte and all spending 2-of-3 multisig inputs.

This leads to the assumption that these transactions are constructed with the

same wallet or by the same entity.

The fingerprint, especially spending 2-of-3 multisig, limits the number of

wallets or entities which the transactions could originate from. Reaching out to

a possible entity, which prefers to remain unnamed, proved to be successful.

They confirmed the two off-by-one-errors. Firstly, the transactions should be

time-locked to the current block height and not the next block height. Secondly,

at least one of the inputs should have a nSequence number of 0xFFFFFFFF-1 or

less for the time-lock to be enforced. A fix for this has been released in early

2020. However, it will take a while before all instances of the currently

deployed software are upgraded.

Between September 2019 and March 2020, about 10.9 million (19%) out of the 57.49 million total transactions set a locktime. Out of these, 1.16 million transactions had an unenforced locktime. That represents 2% of the total and about 10% of all transactions with a locktime. More than 98% of the transactions with an unenforced time-lock share the same fingerprint as the transactions observed on the 17th of December. The remaining 21577 transactions are likely broadcast by other entities. Out of these, 92.5% have an unenforced lock-by-block-height and 7.5% an unenforced lock-by-block-time. Some transactions with unenforced locktimes might have valid use-cases while others unknowingly set an unenforced locktime.

Conclusion

Some bitcoin wallets reduce the profitability of fee-sniping by time-locking

transactions to the next block. This appears as a stair-pattern when plotting

the arrival time and the locktime of transactions. The plot reveals transactions

with locktimes higher than the current block height. These should, usually, not

be relayed through the Bitcoin network. This leads to the discovery that a large

entity transacting on the Bitcoin network does not properly set the nSequence

field of their transaction inputs. This allowed for the off-by-one-error in the

transaction locktimes to remain unnoticed.

I thank David Harding for commenting on an early draft of this article. I found the background information he provided to be very valuable. Any errors that remain are my own.

My open-source work is currently funded by an OpenSats LTS grant. You can learn more about my funding and how to support my work on my funding page.

Text and images on this page are licensed under the Creative Commons Attribution-ShareAlike 4.0 International License

Text and images on this page are licensed under the Creative Commons Attribution-ShareAlike 4.0 International License