The daily BitMEX broadcast at 13:08 UTC

Using a fingerprint to reason about a footprint

Monday, May 4, 2020At around 13:00 UTC every day, BitMEX, a cryptocurrency exchange and derivative trading platform, broadcasts multiple megabytes of large transactions into the Bitcoin network. This affects the transaction fees paid during European afternoons and US business hours. The transaction size could be greatly reduced by implementing current industry standards in the BitMEX wallet. Once activated, utilizing Schnoor and Taproot combined with output batching seems to be the most promising for improving the transaction count and size.

The observation that BitMEX broadcasts transactions every day at around 13:00 UTC is not novel. The transactions are mainly withdrawals initiated by BitMEX users and some internal UTXO consolidations1. As part of their wallet security practice, BitMEX reviews and processes all withdrawals by hand. They claim that doing so multiple times a day would be infeasible and worry that spreading the transaction broadcast over the day, which would lighten the burden on the network, could decrease their user’s experience.

BitMEX transactions have a unique fingerprint which originates from their in-house multi-signature wallet solution. All transactions strictly spend P2SH outputs with 3-of-4 multisig redeem scripts. The four public keys used in the redeem script are uncompressed. The hashed and encoded redeem script result in addresses with the prefix ‘3BMex’2. BitMEX does not spend SegWit outputs, and all transactions have a version of 2. These properties make it straightforward to recognize BitMEX transactions on the chain and in the mempool.

Observations

A dataset consisting of the transactions observed by the Bitcoin Transaction Monitor between September 2019 and March 2020 is used. In these six months, BitMEX broadcast around 415 000 transactions into the Bitcoin network. Summed together, these take up around 593 MB and pay a total miner fee of 181 BTC. This represents about 2.8% of the total bytes and 3.8% of the total fees broadcast in this period.

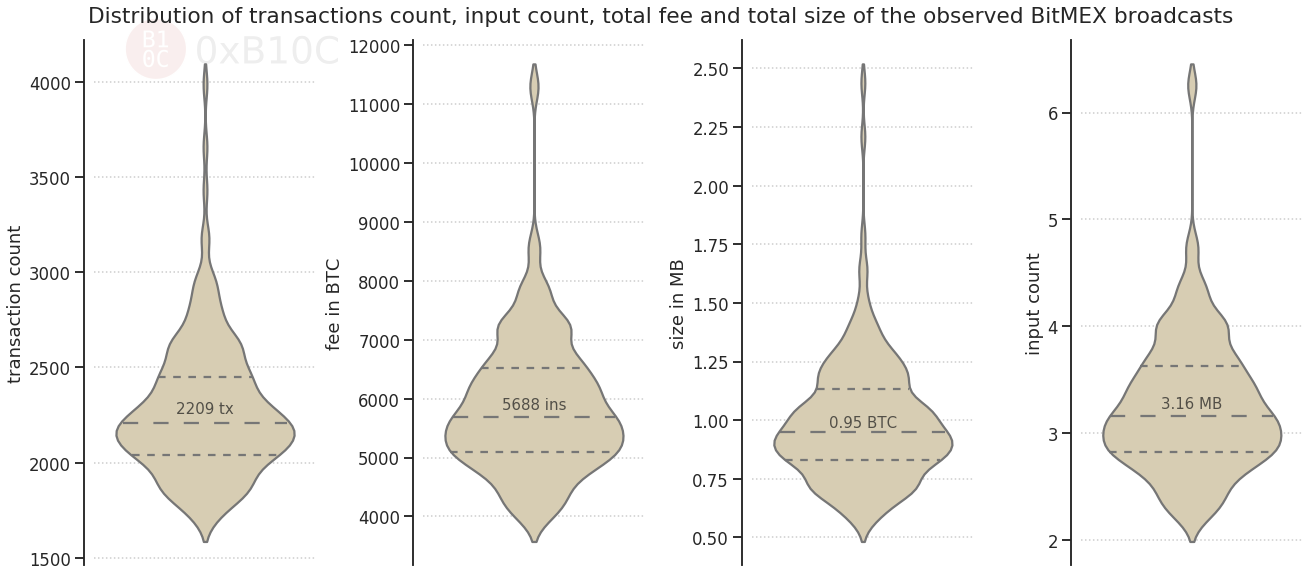

The median broadcast contains 2209 transactions, 5688 3-of-4 multi-signature inputs, pays 0.95 BTC in miner fees, and has a total size of 3.16 MB. The input count, the miner fees, and the total broadcast size grow linear with the transaction count. On weekends, fewer transactions are broadcast than on weekdays, and thus the input count, total miner fee, and broadcast size are usually less.

With more than 500 bytes each, the 3-of-4 multi-signature inputs account for most of the transaction size. About 26% of the transactions have one, 36% have two, 32% have three, 3% have four, and about 2% have five or more inputs. The transactions have either one (46%) or two outputs (54%).

The miner fees for withdrawals are not paid by BitMex. They are deducted from the withdrawing users. The transaction feerate does not depend on the input count nor the transaction size. Users choose a miner fee when withdrawing. However, they do not know how many inputs the final withdrawal transaction will spend and thus can not reason about the transaction size and required feerate. All observed transaction fees are a multiple of 10 000 satoshi, which is the minimum step size the withdrawal frontend allows. 10 000 satoshi is the smallest, and most commonly (44%) observed withdrawal fee. It is followed by 100 000 satoshi (30%), 20 000 satoshi (17.5%), and 50 000 satoshi (3%). The most commonly observed feerates, which result from the combination of a user-picked fee and an algorithmically chosen number of inputs, are 17 (24%), 9 (19%), 60 (16%), 12 (10%), 88 (8%) and 18 sat/vbyte (8%).

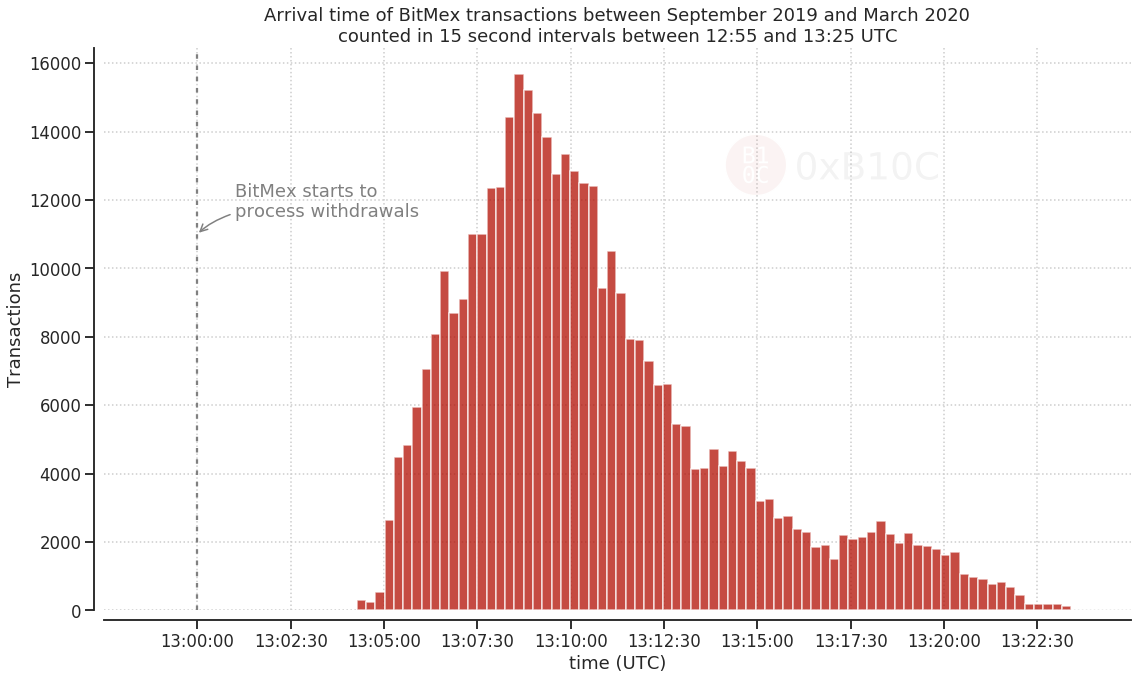

BitMEX starts processing withdrawals at 13:00 UTC. It takes a few minutes before the transactions are broadcast to the network. On some days, the first transactions can be observed as early as 13:05 UTC. In median, the first transaction arrives at 13:08:30 UTC. It takes about 2:14 minutes in median until all transactions arrive on weekdays and 1:57 minutes in median on weekends.

The 25th percentile of broadcast transactions takes about 10 minutes to confirm, the 50th percentile about 27 minutes and the 75th for about 71 minutes. The 80th percentile takes about two hours, the 86th for more than three hours, the 92nd over five hours, and the 99th percentile over ten hours.

Effects

Broadcasting multiple megabytes of transactions at various feerate levels has immediate and noticeable effects on the network. The feerate estimators adjust their recommendations, and the wallets using these recommendations set a higher feerate when constructing a transaction. The minimum feerate for block-inclusion rises and the time-to-confirmation spikes.

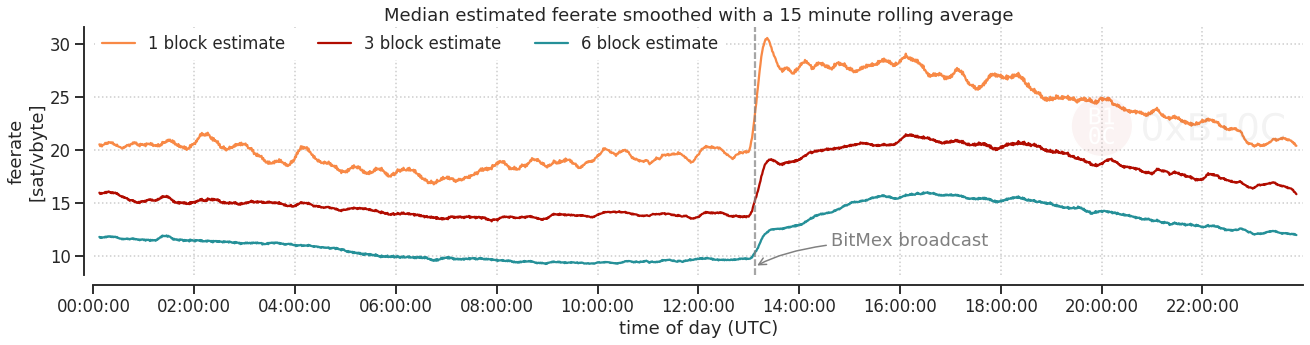

Feerate estimators correctly react to the thousands of large transactions spread over different feerate levels. They recommend paying a higher feerate to outbid the BitMEX transactions, which take up a significant part of the available space in the next blocks. The median estimated feerates for inclusion in the next, in the next three and the next six blocks, increase sharply at around 13:00 UTC. The next block estimate stays at a high level for a few hours. The three and six block estimates continue to increase to a maximum between 16:00 and 17:00 UTC.

The median estimated feerate is calculated by aggregating multiple estimates. For each feerate estimator, the estimates between September 2019 and March 2020 are grouped by minute of day3. The median feerate estimate is picked and averaged with the median estimates of other estimators for the block target. A list of public feerate estimators with their block targets can be found here.

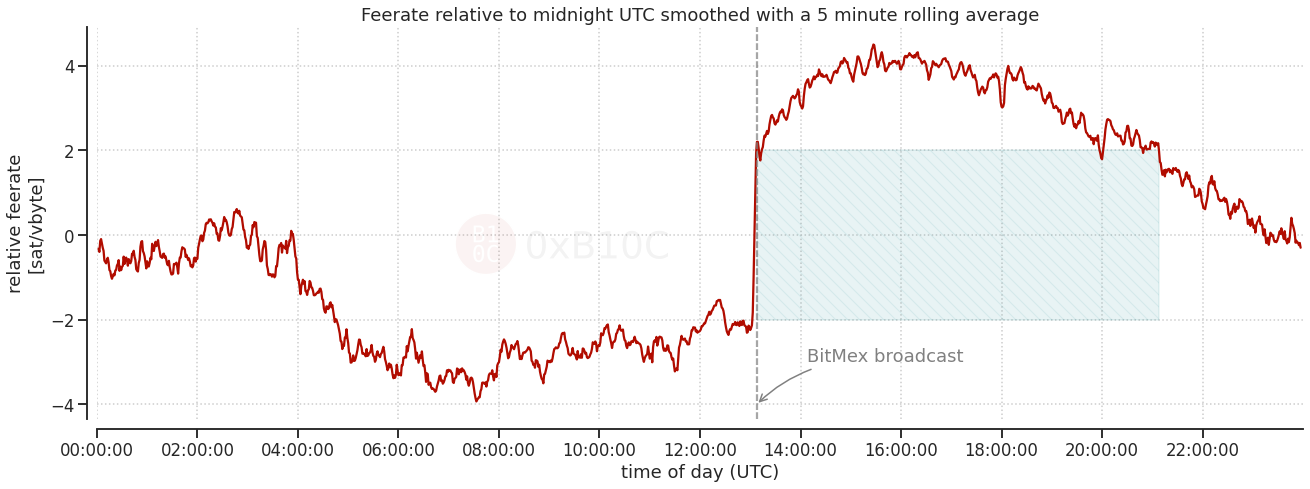

The feerates of the newly arriving transactions react to the increased estimates. The average feerate sharply increases at around 13:00 UTC and continues to rise over the next hours. At about 15:30 UTC, the daily maximum is reached. From there on, the feerate starts to decrease slowly. It takes until around 21:00 UTC before it sinks below the level of the initial spike. At 13:00 UTC, it is afternoon in Europe and morning in the US. The higher network activity at this time likely amplifies and lengthens the effect of the BitMex broadcast. However, most of the near-vertical increase is presumably caused by BitMEX alone. The effect of the US business hours is visible as a slow increase and decrease over multiple hours.

The feerate relative to midnight UTC is grouped by minute of day. The group average is plotted.

Calculating the additional fees Bitcoin users pay as a result of the BitMEX broadcast is hard. There is no data for days without a broadcast to compare to. However, the magnitude of the effect can be estimated. Therefore, the following assumption about the effect is made: The BitMEX broadcast causes an average feerate increase by 4 sat/vbyte between 13:00 UTC and 21:00 UTC. The blue area in the figure above visualizes the assumption. On average, 42.5 vMB of non-BitMEX transactions arrive in the eight hours between 13:00 UTC and 21:00 UTC. If 4 additional satoshi are paid for each broadcast vbyte, then a total of 1.7 BTC of additional fees are paid by Bitcoin users per day due to the BitMEX broadcast. This represents about 17% of the total fees arriving during the eight hours and about 6.8% of the total daily transaction fees. However, it is unclear if the assumption holds. The estimate can only show the magnitude of the average daily effect. One or even multiple days without a BitMEX broadcast would be needed to further study it.

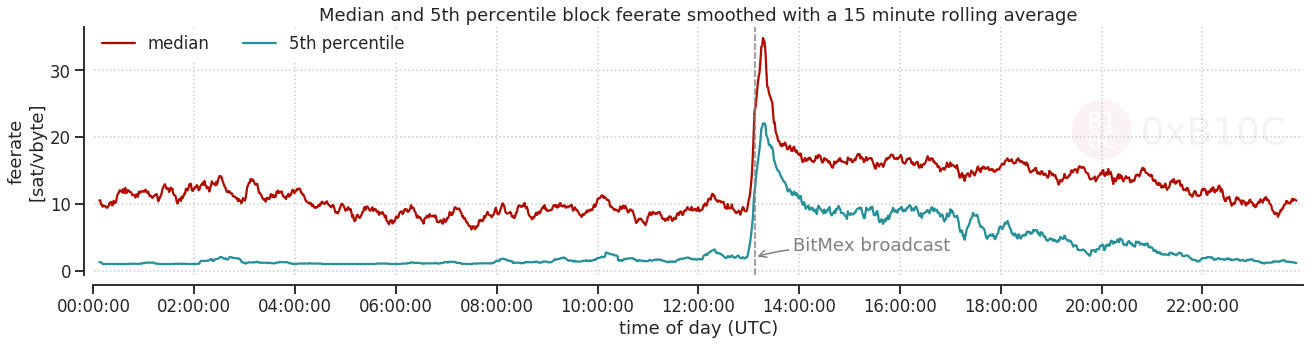

Both the median block feerate and the 5th percentile block feerate spike and stay at an elevated level before slowly declining to pre-broadcast levels at around 22:00 UTC. Transactions send with a low feerate might take a few hours until they are included in a block during this period. The 5th percentile block feerate represents nearly the minimum feerate included a block while not picking up, for example, the parents of child-pays-for-parent transactions.

The median and 5th percentile block feerate are calculated from the blocks in the blockchain. The observed block arrival time (not the miner timestamp in the block header) is used to group the blocks by minute of day. The group median and the 5th percentile are plotted.

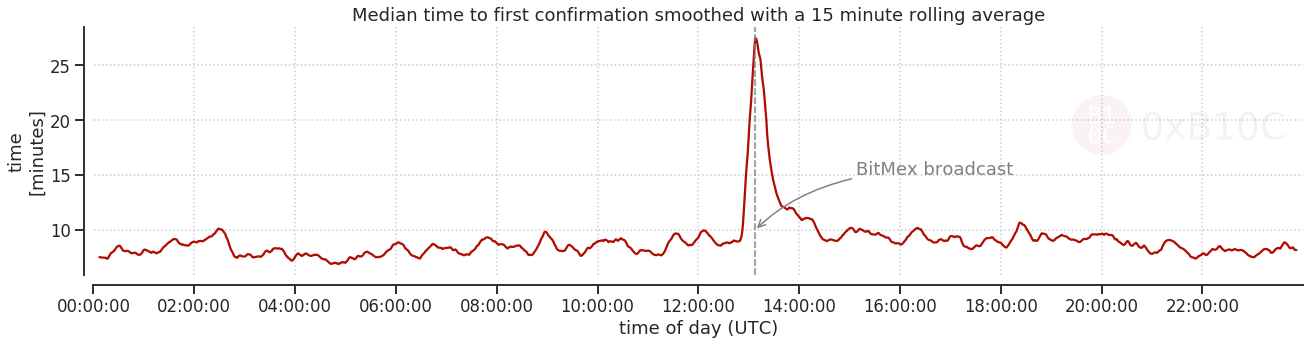

The median time-to-confirmation, the time between a transaction being first observed and its confirmation in a block, spikes between 13:00 and 14:00 UTC and remains at a slightly elevated level until around 21:00 UTC.

Transactions are grouped by the minute of day of their arrival time. The median time-to-confirmation for each minute of day is plotted. Only transactions seen in the mempool and a block are used. Replaced transactions are ignored.

Improvements

The effects can be minimized by reducing the number of bytes broadcast to the Bitcoin network. This can be achieved both by decreasing the transaction count and size of the individual transactions.

The four uncompressed public keys used in every BitMEX input could be replaced by compressed public keys. An uncompressed public key is 65 bytes long and can be encoded in 33 bytes as a compressed public key by leaving out redundant data. Wallets started using compressed public keys as early as 2012, and by 2017 more than 95% of all public keys added to the blockchain per day are compressed4. By using compressed public keys, BitMEX could reduce their transaction size by as much as 23%.

Transaction batching could help to minimize the amount of 3-of-4 multisig change outputs being created. Spending the 3-of-4 multisig outputs makes up for most of the block space used by BitMEX. Every output created needs to be spent by supplying three signatures of around 71 bytes each and a redeem script with four uncompressed public keys of 65 bytes each. This totals at around 532 bytes per input. However, an even more block space-efficient alternative would be to use a non-multisig wallet for user deposits, which are periodically consolidated into a multisig wallet. Spending a few high-value 3-of-4 multisig outputs for multiple withdrawals batched together greatly reduces the overall transaction count. Additionally, BitMEX operational costs for manually reviewing and processing a few high-value transactions per day would likely be lower than they currently are for reviewing a few thousand lower-value withdrawals.

Spending SegWit would help as well. The large scripts used in the 3-of-4 P2SH multisig inputs would be placed in the witness data. There they have less effect on the transaction weight. In December 2019, BitMEX mentioned that their priority lies on upgrading their wallet to use P2SH wrapped SegWit. They estimated around 65% in transaction weight savings for an average withdrawal transaction.

Once activated, BitMEX users and the whole network could greatly benefit from BitMEX utilizing Schnorr and Taproot. The three ECDSA signatures in the inputs of BitMEX transactions with around 71 bytes each can be replaced by a single 64 bytes aggregate signature. The four uncompressed public keys of 65 bytes each can be replaced by a single 32 byte tweaked public key. This public key would be an aggregate of the three most commonly used public keys. It could be tweaked for additional spending conditions5. A single P2TR (Pay-to-Taproot) input does account for around 57 vbytes. This is an 89% reduction when compared to the current input size. Combined with output batching, this could drastically minimize the on-chain footprint of the BitMEX broadcast. Additionally, Taproot would remove the unique fingerprint of BitMEX transactions, which would, in turn, increase the privacy of BitMEX users.

Conclusion

By using the fingerprint of BitMEX transactions, their footprint on the Bitcoin network is observed and discussed. The daily broadcast has a significant impact on the Bitcoin network and user fees. By utilizing scaling techniques, some of which have been industry standards for multiple years, the impact could be reduced. BitMEX is stepping in the right direction by planning to switch to nested SegWit. They, however, shouldn’t stop there.

Disclaimer: I’ve written this article to educate and inform. It’s published without bad intentions and no malice aforethought against BitMEX. I have not been paid to cover this topic by neither BitMEX nor a competitor nor anybody else. The information and data herein have been obtained from sources I believe to be reliable. I make no representation or warranty as to its accuracy, completeness, or correctness. This article has not been extensively peer-reviewed.

These usually don’t contain many inputs, which is untypical for consolidations. On second thought, these might as well be withdrawals to other accounts on BitMEX. ↩︎

I suspect that BitMEX reuses three of the four public keys of their multi-signature setup for multiple addresses (redeem scripts). A fourth and extra public key is used to iterate the redeem scripts until a ‘3BMex’ prefixed vanity address is found. This is clever but wastes 1+65 bytes for each UTXO spent. Additionally, it might not have any security benefit if the fourth private key is not kept. ↩︎

Minute of day: Imagine a vector with 24*60 (1440) entries. The first would be for minute 00:00, the second for 00:01 the sixty-third for minute 01:02, and the last for minute 23:59. ↩︎

I assume that BitMEX currently accounts for the majority uncompressed public keys added to the blockchain per day. ↩︎

If the second footnote holds, then the tweak might not even be required. Bonus: It could, however, be used to create vanity addresses prefixed with, for example,

'bc1mex'('bc1bmex'is not possible as the character'b'can’t be used in the data part of the Bech32 address format). ↩︎